If you’ve ever dreamed of starting your own dairy farm, goat-rearing business, or any livestock-related work but didn’t have enough money to get started — this one’s for you.

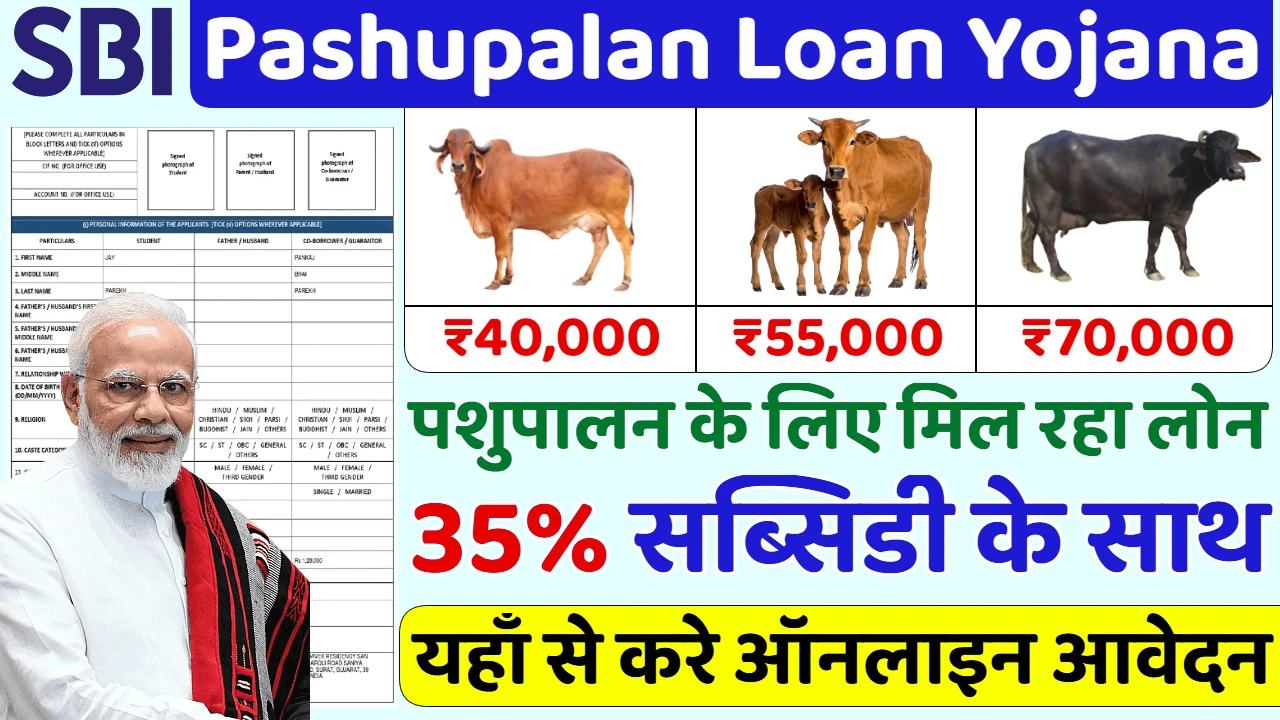

The State Bank of India (SBI) has officially launched the SBI Pashupalan Loan Yojana 2025, a financial support scheme for individuals who want to build a career in animal husbandry. Through this program, you can get loans up to ₹10 lakh with easy terms, low interest, and both online and offline application options.

Let’s unpack how this scheme works, who can apply, and how you can get started with your own livestock business this year.

What Is SBI Pashupalan Loan Yojana 2025?

The SBI Pashupalan Loan Scheme 2025 is designed to encourage people — especially those in rural and semi-urban areas — to start animal husbandry as a sustainable business.

Under this scheme, SBI provides loans ranging from ₹50,000 to ₹10 lakh to help farmers, self-employed individuals, and small entrepreneurs purchase animals, set up dairy units, or expand their existing livestock operations.

The goal is simple: to create income opportunities in rural India by supporting people who want to turn livestock farming into a stable source of livelihood.

Key Highlights of SBI Pashupalan Loan 2025

| Feature | Details |

|---|---|

| Scheme Name | SBI Pashupalan Loan Yojana 2025 |

| Department | Animal Husbandry and Dairy Department |

| Objective | Promote livestock and dairy entrepreneurship |

| Minimum Loan Amount | ₹50,000 |

| Maximum Loan Amount | Up to ₹10 lakh |

| Interest Rate | Around 7% per annum |

| Eligibility | Indian citizens aged 18 years and above |

| Application Mode | Online and Offline |

| Official Website | https://sbi.bank.in |

This scheme isn’t just a bank product — it’s a genuine opportunity for small farmers and rural youth to build something of their own without the constant pressure of finding a job elsewhere.

Who Can Apply for SBI Pashupalan Loan?

Before applying, here’s what you need to know about eligibility criteria:

- The applicant must be an Indian citizen and an existing or new customer of SBI.

- You should have a good credit score (CIBIL) and an active bank account history for at least 6 months to 1 year.

- The applicant’s age should be 18 years or above.

- You should own land or space suitable for animal rearing.

- Basic experience or understanding of animal husbandry is preferred.

- All required documents (ID proof, business plan, income records) must be available at the time of application.

So, if you’ve ever raised cattle, goats, or poultry — even on a small scale — this scheme could help you expand it into a profitable business.

Loan Limit under SBI Pashupalan Yojana

SBI doesn’t have a fixed, one-size-fits-all loan limit for this program. It depends on your business size and repayment capacity.

- Minimum loan amount: ₹50,000

- Average first-time loan: ₹1 lakh – ₹5 lakh

- Maximum limit: Up to ₹10 lakh

If you repay your first loan on time and maintain a clean record, your loan limit can increase for future applications.

Banks also consider your project cost, business plan, and local livestock market rates while approving your final amount.